Sunway Construction Group Bhd (Sept 18, RM1.76)

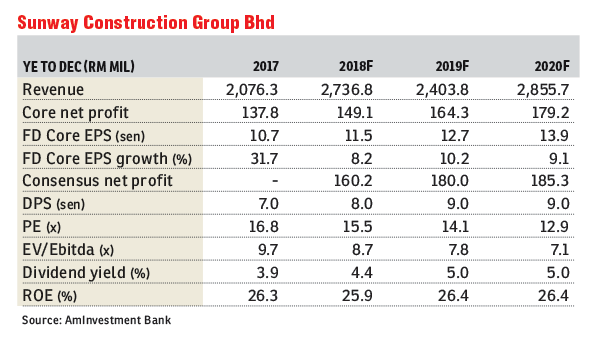

Downgrade to underweight with a fair value of RM1.53: We came away from a recent visit to the company feeling cautious about its outlook. We lower our assumption for job wins in financial years 2018 to 2020 (FY18-FY20) to RM1.5 billion annually (from RM2 billion), to bring ourselves in line with the company’s latest construction order book replenishment target of only RM1.5 billion in FY18.

So far in FY18, Sunway Construction (SunCon) had secured new jobs worth a total of RM854 million, while its outstanding construction order book now stands at RM5.6 billion. Currently, it is eyeing a third-party superstructure job (it stands a very good chance by virtue of it being the piling contractor for the project), as well as parent Sunway Bhd’s various new hospital and shopping mall projects.

We also lower our projected construction billings in FY18-FY20 from SunCon’s light rail transit 3 (LRT3) packages, that is Sections GS07 and GS08 (the outstanding value, at present, is at RM2.1 billion). We understand that works on the six LRT stations under SunCon’s packages have not progressed as Prasarana embarks on initiatives to downsize those stations. In addition, Prasarana is in favour of carrying out the project at a normal pace, versus on an expedited basis previously as the latter incurs various escalation costs (such as overtime expenses).

In anticipation of a lull period ahead for the local construction sector, we understand that a team from Sunway Construction recently visited India to “rekindle past relationships” with some of its former construction joint-venture partners there. SunCon sees opportunities in infrastructure projects in India such as highways, metros as well as high-speed rail.

We remain cautious on the outlook for the local construction sector. As the government scales back on public projects, local contractors will be competing for a shrinking pool of new jobs in the market. Severe undercutting among the players will result in razor-thin margins for successful bidders. On the other hand, the introduction of a more transparent public procurement system under the new administration should weed out rent-seekers, paving the way towards a healthier competition within the local construction sector. — AmInvestment Bank, Sept 18

This article first appeared in The Edge Financial Daily, on Sept 19, 2018.

TOP PICKS BY EDGEPROP

Flat Tasek 64, Bandar Baru Seri Alam

Masai, Johor

Jalan Setia Utama U13/38C

Setia Alam/Alam Nusantara, Selangor